Debt-To-What?

Your Debt-To-Income Ratio (DTI) is the magic number lenders use to see if you’re Loan Ready. We check your income and monthly bills to make sure you’re in the clear. Basically, it’s the “how much can you handle?” test—don’t worry, we’ve got your back!

When you apply for a home loan, lenders will play detective—checking not just your credit score but also your debts and income to figure out your Debt-To-Income ratio (DTI). The lower the DTI, the better! And guess what? Knowing your DTI can actually make the loan process smoother—yes, we said smoother! Ready to crunch the numbers and see where you stand? Let’s do this! 💸🔍

What Determines Your Debt-To-Income Ratio?

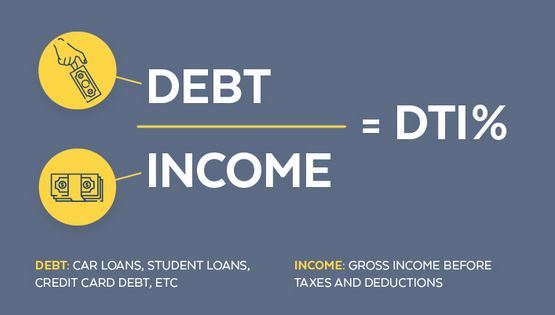

As you probably experienced using the above calculator, DTI can be calculated by taking all of your monthly debt payments divided by your gross monthly income. It’s straight forward but your debt to income ratio (DTI) is a key component that a Lender will analyze when extending credit. It helps the lender determine the potential risk associated with the loan. The higher your debt to income is, the less likely you may be to pay back the loan payments in a timely manner. The lower the debt to income, the more likely you will be to pay the monthly payments on time.

In order to calculate your debt to income ratio, it is helpful to understand the following terms and how they apply to your finances.

Annual Income:

Your Annual Income is the total income received for the year before taxes. This includes a salary, commission, bonus, rental income, etc. You can also use any alimony or child support, if applicable.

If you are self-employed, your annual income will be based on your total annual income after any deductions claimed on the end of year Schedule C.

Auto Payments:

Simply add up all your monthly payments for any automobiles, boats, recreation vehicles, etc.

Credit Card Payments:

You only need to count the required minimum monthly payment, when considering your monthly debt. If you pay extra each month, only count the minimum required payment. If you will pay the liability off at the end of the month, you dont need to count that payment.

Mortgage/Rent Payments:

If you have any existing mortgages that will still be in place after purchasing your new property, they will need to be taken into consideration. Be sure to include taxes and/or insurance on all financed properties, or properties owned as part of the monthly debt.

Other Loan Obligations:

If you have any other required monthly debt obligations, this is where you would add them. Other debt obligations would be payments like student loans, alimony and/or child support, personal loans or any other loan that requires a monthly payment.

Have questions? Give us a call! One of our mortgage specialists would be happy to answer all of your questions.